Why Shell is selling Nigeria onshore oil business for $2.4 billion after 100 years

Shell has sealed a deal to divest its onshore business in Nigeria, marking a significant shift in the company’s century-long presence.

The $2.4 billion agreement sees the Renaissance consortium, comprising ND Western, Aradel Energy, First E&P, Waltersmith, and Petrolin, taking the reins of the Shell Petroleum Development Company (SPDC).

Maintaining operational continuity, Shell emphasizes that the deal is structured to support the SPDC Joint Venture (SPDC JV), where SPDC holds a substantial 30% stake and operates across 18 oil mining leases for onshore and shallow water petroleum operations in Nigeria.

The SPDC JV includes partners like the Nigerian National Petroleum Corporation (55%), Total Exploration and Production Nigeria (10%), and Nigeria Agip Oil Company (5%).

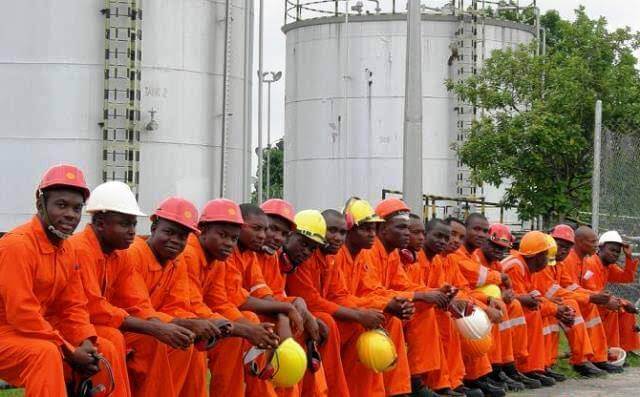

Crucially, as part of the transition, SPDC’s dedicated workforce will seamlessly transition to the new ownership, ensuring continuity and expertise in the industry. Post-completion, Shell commits to continuing its support for the management of SPDC JV facilities, particularly those supplying feed gas to Nigeria LNG (NLNG), while retaining its 25.6% interest in NLNG outside the scope of this transaction.

Although divesting a significant onshore business, Shell’s presence in Nigeria remains substantial post-sale.

Three key businesses—Shell Nigeria Exploration and Production Company (operating in the deepwater Gulf of Guinea), Shell Nigeria Gas (supplying gas to local industries and commercial customers), and Daystar Power Group (engaged in offering solar power solutions across West Africa)—will continue to operate independently.

While this move reflects Shell’s strategic realignment, it also coincides with Nigeria’s ambitious targets set by the oil and gas regulator to boost the country’s oil and condensate production to 2.6 million barrels per day by 2026. Despite being Africa’s leading oil exporter, Nigeria faces challenges such as declining production, attributed to issues like crude theft, pipeline vandalism, and industry underinvestment.

Shell’s transformative decision raises questions about the future dynamics of Nigeria’s oil and gas sector and sets the stage for a new chapter in the country’s energy landscape.

Advantages and disadvantages of this strategic decision

Financial Gain: The divestment allows Shell to generate a substantial amount of capital, which can be reinvested in more lucrative ventures or used to strengthen the company’s financial position.

Focus on Core Operations: By selling off its onshore business, Shell can redirect its focus toward other high-potential areas, such as deepwater exploration and renewable energy, fostering innovation and growth.

Risk Mitigation: Offloading onshore assets in Nigeria may reduce Shell’s exposure to security and operational risks associated with onshore oil operations in the region, potentially minimizing future liabilities.

Portfolio Optimization: The sale enables Shell to streamline its portfolio, concentrating on assets and operations that align with the company’s long-term strategic goals, potentially leading to improved operational efficiency.

Preservation of Presence: Shell’s retention of significant interests in other sectors of Nigeria’s energy industry ensures the company’s enduring footprint in the region, maintaining relationships and influence.

Disadvantages

Diminished Control: Handing over the onshore business to Renaissance means relinquishing direct control over these assets, potentially impacting decisions and operations within the divested segment.

Uncertain Relationships: The changing ownership structure and operatorship may introduce uncertainties in relationships with partners and stakeholders in the onshore business, potentially affecting collaborative efforts and agreements.

Impact on Employees: While Shell plans to retain its employees within the onshore business under the new ownership, the transition may lead to uncertainty and changes in work culture and benefits.

Operational Impact: The transition may introduce operational disruptions and logistical challenges as Renaissance takes over the onshore assets, potentially affecting production and supply chain capabilities temporarily.

READ ALSO: Johann overtakes Dangote as Africa’s richest man… here’s what to know about him

Future Opportunities: Selling the onshore business may limit Shell’s future options in the onshore segment of Nigeria’s oil and gas industry, potentially foregoing opportunities tied to the region’s production growth targets.