FNB Under Fire for Mid-Year eBucks Rule Changes

FNB Under Fire for Mid-Year eBucks Rule Changes. Photo Credit- MyBroadBand

FNB customers are up in arms over the bank’s abrupt decision to tweak its eBucks rewards programme just four months after its annual adjustments, prompting widespread threats to switch banks. The changes, announced recently and set to kick in from November 2025, alter the levelling criteria in ways that strip points from relatively easy-to-achieve behaviours, leaving many feeling shortchanged. Historically, FNB has tweaked its partner list multiple times a year but stuck to annual updates for levelling rules, usually timed a month after banking fee revisions. This time, Premier and Private customers stand to lose 2,500 points on simple actions like routing 80% of monthly spending through a virtual card, exploring credit options under the Nav>Credit page, or simply viewing the “Track My Rewards” tab in the FNB app. To offset this, FNB is dangling up to 1,000 extra points for buying more of its insurance products, while Aspire account holders now face a R5,000 minimum monthly spend threshold plus two new behavioural requirements.

The backlash erupted almost immediately after FNB posted the updates on its website, with social media lighting up with dozens of furious complaints within hours. On Thursday, 2 October 2025, a quick search for “eBucks” revealed a torrent of discontent, including one customer blasting the move as “one of the most underhanded moves against customers, utterly pathetic.” Another long-time user fumed, “FNB is dealing in shockingly bad faith by changing their eBucks terms again mid-year. Over 10 years with FNB. My family is moving to another bank.” A third called it “unethical,” adding, “Never thought I’ll look for another bank but now it’s the time.” Even multi-generational loyalists weren’t spared, with one declaring, “My family has been banking with you for three generations. Your bait-and-switch eBucks rule change has me planning a move.” The sentiment echoed across platforms, with users openly shopping for alternatives amid accusations of bad faith.

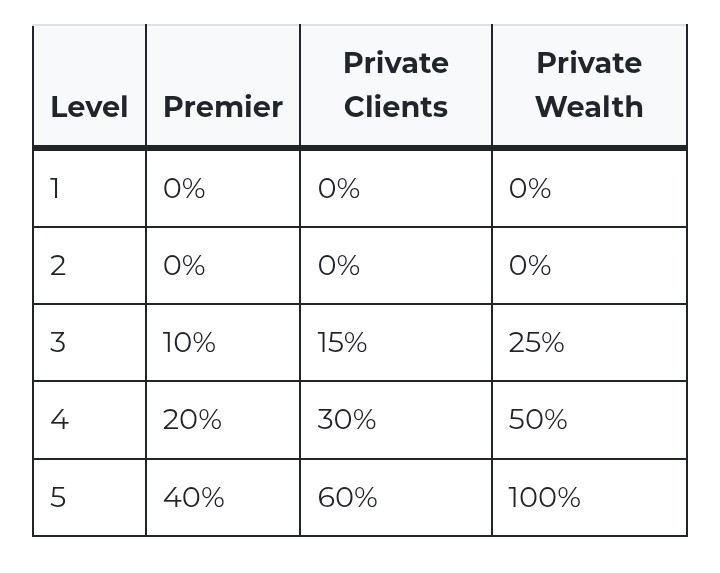

At the heart of the uproar is the impact on FNB’s 24-month device contract discounts through the FNB Connect app, where customers earn back a slice of their monthly instalments on electronics or appliances based on their reward level. Previously, Level 5 Premier customers recouped 40% of instalments, Private Clients 60%, and Private Wealth users a full 100%, often enough to neutralise interest costs. Now, without the slashed points, many teetering on the edge of higher tiers could tumble two levels, say, from Level 5 to 3, drastically cutting rebates. For a R500 monthly instalment, a former Level 5 Premier user might see R200 in eBucks shrink to R50 (10%), while a Private Client drops from R300 (60%) to R75 (15%). The revised earnings table underscores the sting:

FNB’s support team has pushed back on the complaints, insisting the tweaks “better reflect how our customers bank and spend today” and aim to “balance fairness and value across the programme.” In responses to irate users, they added, “We’re always reviewing feedback like yours to improve.” The bank defends its right to amend rules anytime, as per the eBucks terms and conditions, but admits the annual cadence had set customer expectations. When pressed on the hit to device rebates, FNB highlighted the programme’s “market-leading” discounts and noted that while 43,000 points are available for Private Wealth Level 5, only 13,500 are needed. It also touted “more points” overall from November, though the net effect for unchanged behaviours is a 1,500-point dip at minimum. One vocal critic on Twitter/X urged mass complaints to the National Consumer Commission, accusing FNB of “moving the goalposts” after luring users into long-term contracts.

As the dust settles, the controversy exposes fraying trust in FNB’s once-celebrated rewards ecosystem, with customers weighing the hassle of switching against perceived betrayal. While the bank positions the shifts as behavioural incentives benefiting both sides, the swift outcry suggests a misstep in communication and timing. For now, social media remains a battleground, with #eBucks trending amid vows of defection, a stark reminder that in South Africa’s cutthroat banking scene, loyalty is earned one point at a time, but lost in an instant.

FAQs on FNB eBucks rule changes in 2025

What are the main eBucks changes announced by FNB?

FNB is reducing points for simple behaviours like virtual card use and app interactions by 2,500 for Premier and Private customers, while adding up to 1,000 points for extra insurance purchases and a R5,000 spend minimum for Aspire users, effective November 2025.

How do the changes affect 24-month device contracts?

Customers could drop reward levels, slashing rebates, e.g., a Level 5 Premier user on a R500 instalment goes from 40% (R200) back to 10% (R50) at Level 3, with Private Clients seeing similar proportional cuts.

Why are customers angry about the eBucks updates?

The mid-year tweaks, just four months after annual changes, feel like a “bait-and-switch,” breaking expectations of stability and prompting threats to switch banks after years of loyalty.

What has FNB said in response to complaints?

FNB claims the updates reflect modern banking habits, balance value, and remain market-leading, while inviting feedback; it notes only 13,500 points are needed for top Private Wealth levels despite higher totals available.

Can FNB change eBucks rules anytime?

Yes, per the terms and conditions, but the annual levelling tradition had set customer expectations; critics suggest complaining to the National Consumer Commission for potential unethical practices.