Warren Buffett’s Berkshire acquires 5 million shares in UnitedHealth… what this means

Buffett Makes a Comeback: Berkshire Hathaway Invests in UnitedHealth Amid Market Challenges

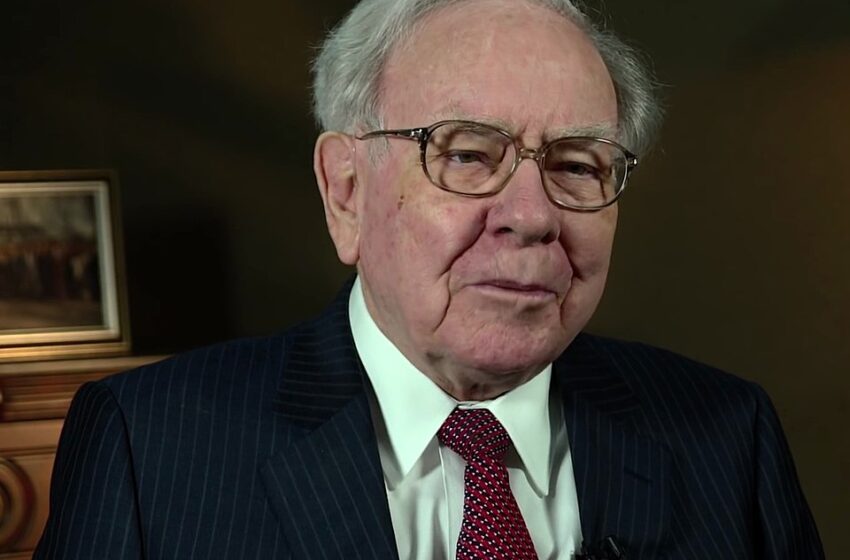

Billionaire investor Warren Buffett, through his firm Berkshire Hathaway, has taken a new position in UnitedHealth Group, purchasing 5 million shares, according to a regulatory disclosure Thursday. The announcement triggered a 7% jump in the health insurer’s stock during after-hours trading.

Buffett is no stranger to UnitedHealth. Between 2006 and 2009, he held roughly 1.18 million shares before exiting the investment entirely in 2010, part of a wider pullback from the health insurance sector.

The move comes at a challenging time for UnitedHealth. The company is grappling with rising medical expenses, federal probes, lingering repercussions from the murder of a top executive, and last year’s cyberattack.

Adding to the pressure, the healthcare giant recently lowered its profit outlook, citing billions in expected additional costs over the next few quarters. The stock has felt the strain, dropping 46% year-to-date, reflecting mounting investor concerns about the company’s near-term financial health.

What this means

1. Buffett’s Confidence in the Long-Term Outlook

Warren Buffett is known for his value-oriented, long-term investing approach. Buying 5 million shares of UnitedHealth indicates that he sees potential in the company’s fundamentals despite short-term challenges. It signals confidence that the insurer can navigate rising medical costs, regulatory scrutiny, and other operational hurdles to deliver value over time.

2. Potential Market Impact

Berkshire Hathaway’s entry is a strong endorsement for investors. Historically, Buffett’s moves often influence market sentiment. The 7% spike in after-hours trading reflects investor optimism that the investment could be a turning point for UnitedHealth. This may attract other long-term institutional investors who follow Buffett’s strategy.

3. Valuation and Opportunistic Buying

UnitedHealth’s stock has fallen 46% year-to-date, suggesting that it may be undervalued by the market. Buffett may view the recent decline as an opportunity to buy quality shares at a discount. This aligns with his strategy of investing when others are fearful, especially if the company maintains strong revenue and market positioning.

4. Signal to the Health Insurance Sector

Buffett previously exited health insurers in 2010, so his return to UnitedHealth is noteworthy. It could signal that he believes the sector has stabilized or that UnitedHealth is well-positioned to overcome industry pressures, potentially influencing sentiment toward other insurers facing similar challenges.

5. Risk Considerations

Despite Buffett’s vote of confidence, UnitedHealth still faces significant headwinds:

-

Rising medical and operational costs.

-

Ongoing federal investigations.

-

Reputational and operational fallout from cyberattacks and executive controversies.

Investors should be aware that while Buffett’s investment reflects long-term optimism, short-term volatility is likely to continue.

Buffett’s purchase is a strong signal of long-term confidence in UnitedHealth, likely boosting investor sentiment and potentially stabilizing its stock. However, the company still faces near-term risks that could affect performance. For value-oriented investors, this move might indicate a potential buying opportunity, but caution remains warranted given current challenges.