Trump pushes ‘Trump Accounts’ as tax season opens, with banks and corporations matching $1,000 child savings boost

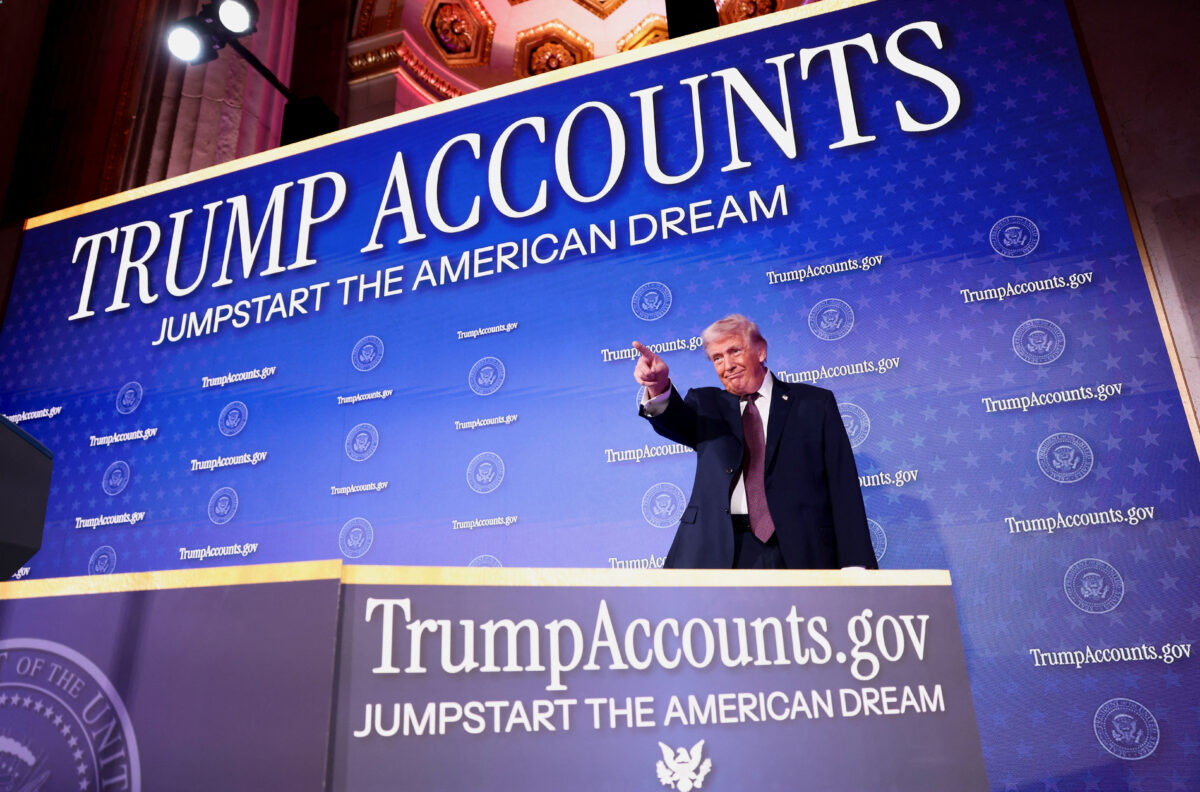

U.S. President Donald Trump points a finger onstage at the U.S. Treasury Department’s Trump Accounts Summit, in Washington, D.C., U.S. January 28, 2026. REUTERS/Kevin Lamarque

As the 2025 tax season opens, President Donald Trump is urging American families to sign up for newly created “Trump Accounts,” a flagship initiative under his administration’s tax and spending legislation aimed at jumpstarting long-term wealth building for children.

The accounts, which officially launch later this year, come with a $1,000 federal contribution for eligible newborns and have already attracted major corporate backing, including commitments from JPMorgan Chase, Bank of America, BlackRock, Charles Schwab, Robinhood, SoFi and BNY.

The push comes as the White House intensifies its economic messaging amid voter concerns over affordability and long-term financial security.

What Are Trump Accounts?

Trump Accounts are tax-advantaged investment accounts created for children, designed to grow over time by investing in funds that track the broader U.S. stock market.

Under the program:

- The U.S. Treasury deposits $1,000 for every child born between January 1, 2025, and December 31, 2028

- Families can make annual contributions of up to $5,000

- Employers may add up to $2,500 per year per employee

- Funds cannot be withdrawn until the child turns 18

The initiative is part of what the administration describes as a long-term strategy to reduce the wealth gap and promote early investing.

How Families Can Sign Up During Tax Season

To receive the federal contribution, parents must open a Trump Account while filing their tax returns, using IRS Form 4547.

According to Treasury officials, elections made during tax filing will activate the account ahead of its July 4, 2026 launch date, which coincides with America’s 250th anniversary.

Families with older children may also qualify for additional funding through private and philanthropic contributions, depending on income and ZIP code eligibility.

Major Banks and Employers Match Government Contributions

Momentum behind the program has grown rapidly, with JPMorgan Chase and Bank of America announcing they will match the federal government’s $1,000 contribution for eligible employees’ children.

Other major financial institutions and companies, including BlackRock, BNY, Charles Schwab, Robinhood, SoFi and Uber, have pledged similar matches.

“We’re making it easier for families to start saving early and invest wisely,” JPMorgan CEO Jamie Dimon said, calling the program a step toward long-term financial stability.

READ ALSO

Gavin Newsom takes Trump fight global at Davos, then gets blocked from U.S. Pavilion

Projected Growth and Long-Term Value

The Trump administration estimates that:

- A $1,000 account opened in 2026 could grow to $5,800 by age 18

- A family contributing the maximum $5,000 annually could see balances reach over $300,000 by adulthood

All funds must be invested in broad-market tracking vehicles, ensuring diversified, long-term growth rather than short-term withdrawals.

Political Timing and Economic Pressure

The rollout comes as polling shows economic anxiety remains high. A recent national survey found that 65% of voters believe a middle-class lifestyle is increasingly out of reach, while a majority disapprove of Trump’s overall handling of the economy.

Still, administration officials argue Trump Accounts offer tangible, measurable benefits to families, especially when paired with employer and private-sector participation.

FAQ

What are Trump Accounts?

Trump Accounts are government-backed, tax-advantaged investment accounts for children, funded initially with $1,000 from the U.S. Treasury.

Who qualifies for Trump Accounts?

Children born in the U.S. between 2025 and 2028 are automatically eligible. Some older children may qualify through private or employer-funded programs.

How do I open a Trump Account?

Parents must select the option when filing taxes using IRS Form 4547.

Is Trump really giving $1,000 per child?

Yes. The federal government will deposit $1,000 per eligible child, with many employers offering matching contributions.

Can parents withdraw money early?

No. Funds are locked until the child turns 18 years old.

Which companies are matching Trump Accounts?

JPMorgan Chase, Bank of America, BlackRock, BNY, Robinhood, SoFi, Charles Schwab, Uber and others.

When do Trump Accounts officially start?

Accounts go live July 4, 2026, with contributions beginning immediately after.

Are Trump Accounts taxable?

They are tax-advantaged, similar to retirement-style investment accounts, with growth sheltered under federal rules.