Top 10 events that shook Nigerian Businesses and shaped the economy in 2023

By ‘Tosin Toluwaloju

In the intricate dance of a nation’s economic ecosystem, businesses serve as catalysts for change, influencing the economy through innovation.

The health and adaptability of businesses not only reflect but actively influence the pulse of a country’s economic and social environment, charting a course towards prosperity and sustainability.

Here are top ten events that shook Nigerian business climate and shaped the economy.

Naira Redesign Policy : On 26 October 2022, the former Governor of the Central Bank of Nigeria (CBN) Mr Godwin Emefiele announced that the highest denominations of the Naira, the Nigerian currency, (N200, N500 and N1000 notes) would be redesigned, giving a deadline of 31 January 2023 for all old notes to be deposited in banks in exchange for new ones. According to the CBN, the new notes would help curb corruption and currency fraud, tackle the growing menace of kidnapping for ransom, lower inflation and address the problem of having too much money in circulation. However, this policy witnessed a lot of downsides and hardships as faced by citizens and grossly affected the ease of doing business. After a back and forth and intervention of the supreme court, it was announced that the old notes will remain legal tender till December 31st 2023. The Central Bank of Nigeria in November via a statement enjoined the general public to continue to accept Naira bank notes both new and old as they remain legal tender even beyond December 31st, 2023.

Petrol Subsidy Removal: Over the years, attempts at removing petrol subsidy by past administrations triggered protests and stiff resistance. After his swearing in on 29th of May, 2023, President Bola Ahmed Tinubu removed fuel subsidy in Nigeria This immediately saw a spike in fuel prices.

The withdrawal of the fuel subsidy has led to a 250 to 300 per cent surge in fuel costs (N600 – N670) across the country with small and medium-sized enterprises facing difficulties in accessing affordable power. This policy triggered a chain reaction, causing higher transportation costs and ultimately contributing to inflation, rise in the cost of food and services with a ripple effect on the purchasing power of consumers.

However, in a bid to reduce the effect of the subsidy removal, the federal government launched a palliative mechanism which was disbursed through states, such as free transportation system in some states of the federation, food palliative, cash transfers, e.t.c.

Revised Foreign Exchange (FX) Windows:

As part of the series of immediate changes to operations in the Nigerian FX market, the CBN in June 2023 introduced a revised FX policy, unifying multiple windows into one. The apex bank said all FX windows were forthwith collapsed into the investors & exporters (I&E) window.

Since the development, the FX official market rate has continued to fluctuate uncontrollably, dancing to the rhythm of the import-export balance, the actions of so-called FOREX cabals, and other macroeconomic factors.

While this aimed to improve transparency and access to forex, it also brought concerns about potential market volatility and affected businesses as well as the prices of goods and services.

Oil Production Quota Debacle: In September 2023, data from the Organization of the Petroleum Exporting Countries (OPEC) reveals a 9.3% surge in Nigeria’s oil output, reaching 1.18 million barrels per day (mb/d) compared to July’s 1.08 mb/d. Despite this increase, Nigeria’s oil production remains below both the OPEC-allocated quota of 1.74 mb/d and the 1.69 mb/d projected in the 2023 budget.

OPEC’s decision in June 2023 to slash Nigeria’s future quota by over 20%, from 1.74 mb/d to 1.38 mb/d, effective from January 2024 if output levels persist, underscores the challenges. The current shortfall hampers Nigeria’s ability to leverage the fiscal benefits of surging crude oil prices, exceeding $90 per barrel.

This production data highlights Nigeria’s persistent hurdles in oil production, encompassing issues such as crude oil theft, outdated infrastructure, and other systemic challenges. As Nigeria navigates these obstacles, the nation grapples with optimizing its crude oil production for sustained economic resilience and fiscal stability.

43 Item Ban Lift: In its quest to boost liquidity in the foreign exchange market, the CBN announced the lifting of the ban on 43 items previously restricted from accessing forex.

The decision came amid high levels of volatility experienced in the FX market following the unification of all trading windows into the investors’ and exporters’ (I&E) window — the official FX market.

In 2015, the bank restricted some items from accessing forex. The restriction was placed to reduce foreign exchange demand for products that could be locally produced.

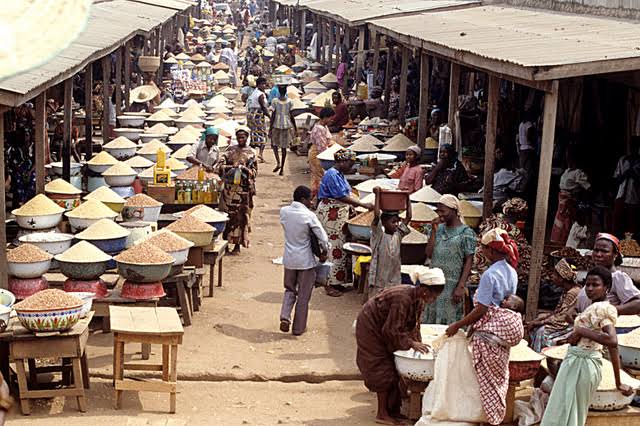

According to CBN, the forex restriction placed on cement, rice, tomatoes, and 40 other products contributed to the hike in dollar rate in the parallel market.

The bank added that the restriction, which was intended to reduce demand for forex in the official market, pushed demand for FX to the parallel market.

Some of the 43 items are; Rice, Cement, Margarine, Palm kernel/palm oil products/vegetable oils, Meat and processed meat products, among others.

Cash scarcity/ Withdrawal Limit: On August 1, 2023, the apex bank exempted microfinance banks (MFBs) and primary mortgage banks (PMBs) from paying processing fees for withdrawals above the cash withdrawal limits.

The move came months after the CBN initiated the cash withdrawal limits policy – which commenced on January 9, 2023.

In December 2022, the CBN directed deposit money banks and other financial institutions to ensure that over-the-counter cash withdrawals by individuals and corporate entities per week do not exceed N100,000 and N500,000, respectively.

But after several pressures, the bank increased the maximum weekly limit for cash withdrawals across all channels by individuals and corporate organisations to N500,000 and N5 million, respectively.

The apex bank said in compelling circumstances where cash withdrawal above the specified limit is required for legitimate purposes, a processing fee of 3 percent and 5 percent will be charged for individual and corporate organisations, respectively.

According to the CBN, the aim is to boost the cashless policy and reduce the amount of cash outside the banking system.

Dangote Refinery: On May 22, 2023, the Dangote Refinery was inaugurated in Lagos, Nigeria. This monumental $19 billion facility stands as Africa’s largest oil refinery and the world’s largest single-train refinery.

The refinery aims to revolutionise crude oil refining in Africa, marking a significant turning point for the oil business in Nigeria and the continent as a whole. With a daily production capacity of 650,000 barrels, it will enable Nigeria to meet its domestic fuel needs, reduce imports, and eliminate fuel shortages.

Unemployment Rate:

Nigeria’s unemployment rate significantly declined to 4.1 percent in the first quarter (Q1) of 2023 from 5.3 percent in the fourth quarter of 2022, according to the National Bureau of Statistics (NBS).

This record falls below the fourth quarter (Q4) of 2020, when the bureau had pegged the country’s unemployment rate at 33.3 percent.

According to NBS, the unemployment report adopted a new methodology and presented an in-depth analysis of the labour market.

The agency said the revised methodology defines employed persons as individuals who are working for pay or profit and who worked for at least one hour in the last seven days against 40 hours.

However, while this shift potentially captured a wider range of informal workers, it also sparked questions about the comparability of the old and new data. Critics argued that the lower threshold could inflate the employment rate, masking underlying challenges in the labor market. They also raise concerns about the potential for misclassification, as individuals engaged in occasional activities or sporadic gigs might be counted as employed.

Inflation Rate: Inflation is an increase in the prices of goods and services over time due to an imbalance between demand and supply.

Nigeria’s inflation rate in September rose for a ninth consecutive month from an already high 25.8%, recorded in August.

Inflation Rate in Nigeria increased to 28.02 percent in November from 21.82 percent in January.

This shift impacted businesses and households as the country witnessed a soaring price in the cost of goods and services.

Debt Rate: Nigeria’s public debt grew at a rate of 75.29% on a quarter-on-quarter basis. According to the report by the Nigeria Bureau of Statistics, Nigeria’s public debt stock which includes external and domestic debt stood at N87.38 trillion equivalent to US$113.42 billion in Q2 2023 from N49.85 trillion US$ 108.30 billion in Q1 2023, indicating a growth rate of 75.29% on a quarter-on-quarter basis.

The impact of government debt on economic growth remains contentious as debt levels have continued to rise steadily. This has contributed to persistent inflation, which has eroded the purchasing power of the country’s citizens, impact interest rates, which is the cost of borrowing money as well as exchange rates.

READ ALSO: Unilver, Bolt…. top companies that left Nigeria over poor economy (see list)

The removal of petrol subsidy, the unified foreign exchange policy, inflation and debt rate have all significantly influenced the business and economic landscape of Nigeria.

As businesses grapple with these seismic shifts, the need for adaptability and resilience have become more imperative in the ever-evolving business landscape in Nigeria.