SARS shares new update ahead of e-filing rush — what it means for taxpayers

SARS upgrades digital platforms to enhance service delivery – expect brief disruptions on 15 July

The South African Revenue Service (SARS) has announced a series of proactive measures to ensure a smooth and efficient experience for taxpayers during the upcoming tax season. With millions expected to use the SARS eFiling platform in the coming weeks, the agency has introduced a virtual waiting room feature designed to handle increased web traffic and prevent system overload.

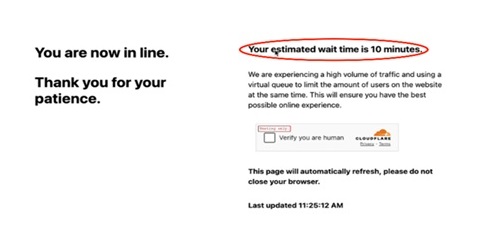

According to SARS, the virtual queue system will automatically place users in a line during periods of high demand. Instead of encountering error messages or slow loading times, users will receive a notification informing them of their place in the queue and an estimated waiting time. This approach aims to create a more orderly experience and reduce the frustration that often accompanies peak-time access.

One of the notable benefits of this virtual waiting room is that users do not need to refresh their browsers or attempt to rejoin the queue manually. Once it is their turn, they will be automatically redirected to the eFiling login page, allowing for a seamless transition into the platform. SARS emphasized that this method ensures fairness and system stability while prioritizing taxpayers’ time and convenience.

The agency, in its 17 July update, also expressed gratitude to taxpayers for their patience and understanding, particularly during peak periods. SARS reiterated its commitment to making the filing process as stress-free and efficient as possible, stating that the new measures are part of broader efforts to continually improve digital tax services in South Africa.

SARS’s eFiling platform, which officially launched in 2003 after a pilot phase in 2000, has long aimed to simplify tax processes for individuals, businesses, and tax practitioners. The platform is free and has evolved significantly over the years, with continuous upgrades that reflect advancements in technology and user expectations. The latest enhancement—the virtual waiting room—is yet another step in that evolution, aligning with global best practices in managing large-scale digital service delivery.

By implementing this feature, SARS is ensuring that the growing number of digital users can access the platform with minimal disruption, even during the busiest times. Taxpayers are encouraged to file their returns early and make use of the available support services to avoid delays. The virtual queue is designed not just as a technical fix, but as part of a broader philosophy of transparency, efficiency, and user-focused service.

Overall, the new system reflects SARS’s readiness to accommodate a growing digital audience while maintaining a high standard of service delivery. It is a strategic move that signals the agency’s commitment to modernization, resilience, and its understanding of the real challenges users face when trying to fulfill their civic duty.

Read the update below: