South Africa Smart ID shift: What you need to know

South Africa Smart ID

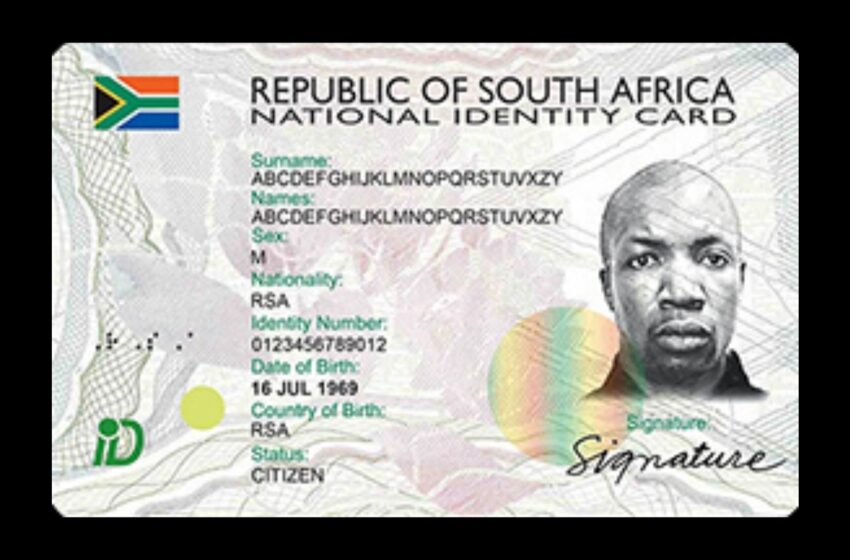

South Africa is embarking on a sweeping digital transformation of its ID system, planning to fully phase out the traditional green ID book by 2029. While the Smart ID card offers enhanced security and convenience, experts warn that the government must address cost and accessibility challenges, especially for low-income South Africans.

Why the Green ID Book Is Becoming Obsolete

The green bar-coded ID, in circulation since 1986, has been flagged as a major fraud risk. Home Affairs Minister Leon Schreiber described it as “the weakest link” in the national identity system, due to rampant counterfeiting. Despite 18 million copies still in use, the card simply doesn’t match modern security standards.

What Makes the Smart ID Card Secure and Modern?

Launched in 2013, the Smart ID card is a biometric document embedded with facial and fingerprint data, and even voting status. Its advanced design makes it far more resistant to fraud and identity theft. Over 1.4 million permanent residents and citizens have already upgraded from the green book.

Timeline: The Road to Full Digital Rollout

- Early 2025: Phasing out green book production begins across Home Affairs offices.

- March 2026: Expanded Smart ID services launched in 100 bank branches.

- March 2028: Additional 1,000 branches equipped for Smart IDs.

- End‑2029: Green ID books fully retired and replaced nationwide.

Concern: Smart ID Fees Could Exclude the Poor

From July 1, 2025, the cost for real-time digital verification increased from R0.15 to R10—a 6,500% jump, sparking fears this could marginalize low-income citizens. Prof. Stella Bvuma of the University of Johannesburg warns the move could lock vulnerable people out of essential services. Banks like Capitec have vowed to absorb the fee, while others express concern it’s a de facto tax on the poor.

Partnerships with Banks: A Smart Fix?

To broaden access, Home Affairs plans to integrate Smart ID issuance into bank branches and digital platforms. Many banks already conduct FICA verifications and could offer mobile enrollment via apps, using cameras and fingerprint scanners. This initiative, dubbed “Home Affairs at Home”, aims to reduce queues and bureaucratic hurdles.

READ ALSO

US Congress potential sanction against South Africa…what you should know

South Africa Passport climbs global rankings: What it means for travelers

Addressing the Digital Divide

While urban centers generally have digital infrastructure, townships and rural areas lag behind. Experts emphasize that without targeted investment, digital roll-outs risk reinforcing existing inequities. Ensuring access across all communities is vital for the program’s success.

Benefits Beyond Security

The Smart ID will empower citizens to:

- Securely open bank accounts and access online financial tools

- Vote confidently with tamper-resistant ID verification

- Use simplified digital services, from healthcare to government benefits

It also strengthens national security by helping prevent fraud, identity theft, and money laundering.

Why This Matters

South Africa’s shift represents a major step into the digital age, improving identity protection while potentially expanding financial inclusion. But this progress must be balanced with affordability, rural access, and avoiding unintended harm to disadvantaged populations. The coming years will be crucial to achieving equitable rollout.

Toward a Smarter ID System

The Smart ID initiative marks a landmark leap in transforming South Africa’s identity framework—making it safer, smarter, and digitally forward. However, success depends on addressing the cost barrier, ensuring widespread access, and completing the phase-out of the green ID book by 2029. As the nation moves toward a more inclusive digital future, every stakeholder must ensure no one is left behind.