Is the Nvidia $500B bookings and U.S. supercomputer deals strong enough to keep U.S. ahead in the Global tech race?

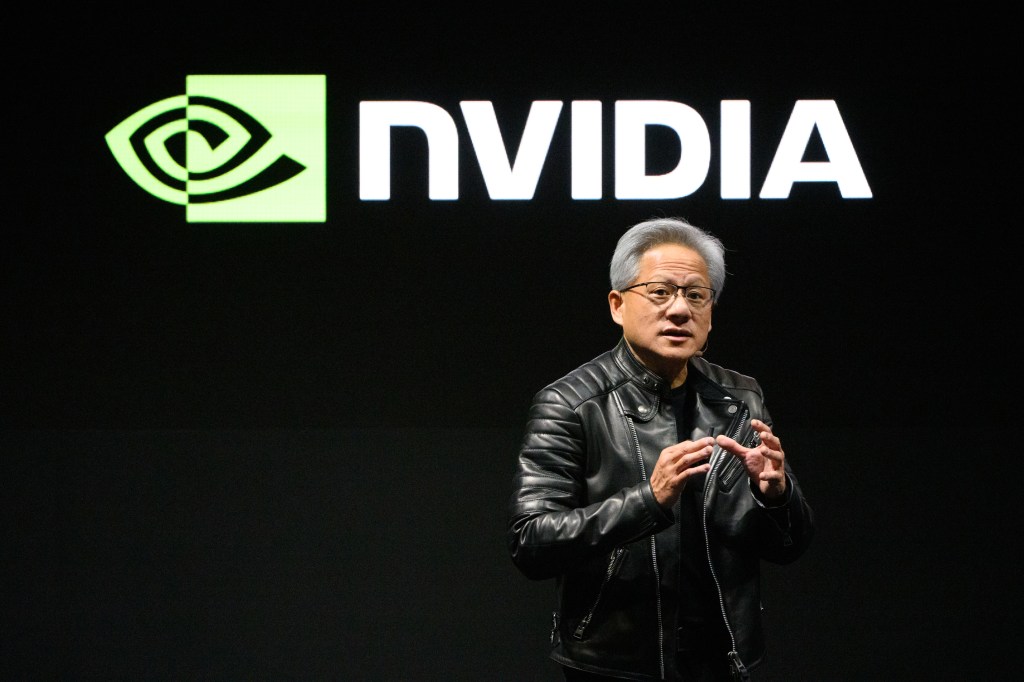

Nvidia CEO Jensen Huang unveils U.S. AI supercomputer deal. Image Source: Akio Kon/Bloomberg / Getty Images

Nvidia has made a dramatic new play in the artificial-intelligence arms race by signing an agreement to build seven new supercomputers for the U.S. Department of Energy (DOE). According to CEO Jensen Huang, the company already holds about $500 billion in bookings for its advanced chips, reinforcing Nvidia’s central role in the global AI rollout.

With this deal, Nvidia isn’t just supplying hardware, it’s positioning itself at the heart of U.S. national-security and energy research. The supercomputers will support programmes ranging from nuclear arsenal maintenance to alternative-energy innovation, underscoring Nvidia’s transition from commercial AI provider to strategic infrastructure partner.

Dominating the AI Chip Market While Manufacturing Comes Home

In recent years, Nvidia has pledged to manufacture its AI infrastructure domestically. The company plans to build AI servers and chips with U.S.-based production partners, amassing up to $500 billion in U.S. infrastructure investment over the next four years.

By locally producing its flagship “Blackwell” series chips and setting up assembly lines in Texas and Arizona, Nvidia is aligning its business strategy with U.S. policy priorities on technology sovereignty and supply-chain resilience. That helps explain why Nvidia’s latest investments are anchored in American soil even as its ambitions remain global.

READ ALSO

Meet NEO: The $20,000 humanoid robot that can do your chores, but at a privacy cost

Global Ambitions Meet Geopolitical Boundaries

Despite its U.S.-centric manufacturing push, Nvidia is acutely aware of its global footprint, especially in China. At the Washington event, Huang addressed the trade tensions directly: while the U.S. needs to “win the AI race” with an American tech stack, he also admitted that China remains “a very important market”.

The balancing act is delicate: exporting top-end chips to China raises national-security concerns in Washington, yet excluding China risks losing access to developers and scale. Nvidia’s global strategy now must navigate geopolitical headwinds while scaling AI infrastructure across continents.

Expanding into New Markets Beyond Data Centres

Nvidia’s reach goes well beyond chips for data racks. The company’s recent deals with banks, telecoms and infrastructure firms illustrate this expansion. For example, Nvidia backed a $40 billion investment by the AI Infrastructure Partnership into U.S. data-centre operator Aligned Data Centers, positioning itself nearer to the edge of the AI value chain.

From self-driving cars to 6G base stations and robotic factories, Nvidia is actively diversifying. Its blueprint for AI “factories” forecast a shift from pure cloud-data-centre deployments toward real-world automation and intelligence systems, essentially embedding Nvidia inside the next industrial revolution.

Stock Surge Reflects Growing Market Confidence

Market watchers responded quickly: Nvidia shares jumped 5% following the DOE announcement and bookings disclosure. The firm’s valuation has flirted with a record $5 trillion, making it one of the most valuable companies on the planet.

Analysts believe the convergence of manufacturing, global sales, and infrastructure deals gives Nvidia a rare trifecta of growth drivers, chips, AI services and geopolitical alignment, all in one portfolio.

Risks and Future Challenges

Despite the momentum, Nvidia faces headwinds. The company must deliver on its massive bookings and execute large-scale production without supply-chain disruptions. Geopolitically, its reliance on global markets invites regulatory risk, especially if U.S.-China tech tensions intensify.

Moreover, Nvidia’s ambition to embed itself in everything from autonomous vehicles to energy science brings increased complexity. Execution on novel domains is harder than scaling chips, and any misstep could challenge investor confidence.

FAQ

What is Nvidia’s deal with the U.S. Department of Energy?

Nvidia has agreed to build seven AI supercomputers for the DOE, supporting applications from national security to energy and scientific research.

How big are Nvidia’s bookings today?

CEO Jensen Huang stated Nvidia holds around $500 billion in bookings for its advanced AI chips and infrastructure.

Why is Nvidia producing more manufacturing in the U.S.?

Nvidia’s U.S. production shift strengthens supply-chain resilience, aligns with U.S. tech-sovereignty policies and brings manufacturing closer to core markets.

What role does China play in Nvidia’s strategy?

China remains a vital market for Nvidia’s long-term scale, but export restrictions and geopolitical risks are complicating Nvidia’s access there.

What new markets is Nvidia entering?

Nvidia is expanding into AI infrastructure deals, self-driving vehicles, telecom 6G systems and robotic factories, moving beyond traditional data-centre hardware.

Is Nvidia’s growth sustainable?

While Nvidia’s positioning is strong, its growth depends on successful execution across complex new domains and navigation of global regulatory risks.