Michael Burry quits the market? ‘Big Short’ legend deregisters Scion Asset Management amid bold new move

Michael Burry at the “Big Short” premiere in 2015. Image Credit: Jim Spellman/WireImage/Getty Images

Michael Burry, the famed investor who predicted the 2008 financial crisis and inspired The Big Short, has officially deregistered his hedge fund, Scion Asset Management, according to an SEC filing effective November 10. The move comes as Burry tells investors he plans to liquidate the fund and return capital by year’s end.

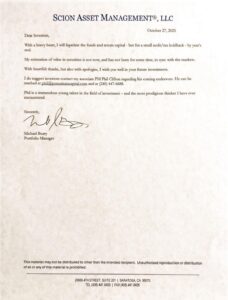

A letter dated October 27, circulating on social media, showed Burry explaining that his “estimation of value in securities is not now, and has not been for some time, in sync with the markets.” He described the decision as “with a heavy heart,” adding that he would maintain only a small audit/tax holdback during the process.

A Legendary Investor Steps Away from Wall Street

Burry, known for his contrarian predictions, rose to fame after correctly betting against the U.S. housing market in 2008. Since then, every move from his hedge fund, Scion Asset Management, has been closely watched for signs of market bubbles.

This deregistration signals a potential shift toward a more private structure, possibly a family office, as speculated by industry observers. Investment managers with less than $100 million in assets under management are no longer required to file regular reports with the SEC, offering greater operational flexibility.

READ ALSO

Has Bitcoin entered its ‘Fall Season’? Morgan Stanley warns of a critical turning point

Clarifying the Palantir Trade Confusion

Rumors recently swirled online suggesting Burry had placed a massive $912 million bearish bet on Palantir. However, Burry personally corrected the record, explaining that his position totaled just $9.2 million across 50,000 contracts at $1.84 each.

Each contract represented 100 options to sell Palantir stock at $50 by 2027. The correction highlighted Burry’s transparency, and the extent of misinformation circulating about his trades.

Warning Against Big Tech and AI “Profit Illusions”

Burry has been vocal about what he calls profit manipulation in the tech and AI sector. He accused major cloud and AI infrastructure companies like Nvidia, Microsoft, Google, and Meta of artificially inflating profits by extending the “useful life” of their assets.

He estimates that between 2026 and 2028, these accounting tactics could understate depreciation by as much as $176 billion, misleading investors about true profitability.

As Burry puts it, “the system is rigged”, and his exit could be both a warning and a prelude to a new market play.

“On to Much Better Things”, What’s Next for Burry?

Burry has teased a major announcement for November 25, suggesting that his withdrawal from Scion may precede a new phase in his investment career. His cryptic post, “On to much better things,” has fueled speculation that he’s shifting toward a more independent strategy or personal investment vehicle.

Observers note that his X profile name, “Cassandra Unchained,” alludes to the mythological prophet who spoke truths no one believed, a fitting metaphor for an investor who often stands against mainstream sentiment.

FAQ

Q1. Why did Michael Burry deregister Scion Asset Management?

Burry deregistered Scion Asset Management after years of market misalignment. He stated his valuation of securities no longer aligns with overall market trends and opted to return investor capital by year’s end.

Q2. What does deregistering from the SEC mean?

It means Scion Asset Management is no longer required to file reports with the Securities and Exchange Commission, signaling a possible shift to a private investment structure or family office.

Q3. Did Michael Burry really make a $912 million bet against Palantir?

No. Burry clarified that his Palantir position was only $9.2 million, based on 50,000 put option contracts, not $912 million as widely misreported.

Q4. What are Michael Burry’s concerns about AI and tech stocks?

Burry warns that major AI and cloud companies, including Nvidia and Microsoft, are inflating profits by extending depreciation schedules for hardware assets. He believes this practice could distort earnings by up to $176 billion through 2028.

Q5. Is Michael Burry quitting investing?

Not necessarily. While he’s shutting down Scion, he has hinted at a new project launching November 25, suggesting a strategic pivot rather than retirement.

Q6. What is Michael Burry’s new venture?

Burry hasn’t revealed details yet but teased “much better things” ahead. Market watchers speculate it could be a private investment vehicle or a new form of capital management outside SEC oversight.

Q7. What does this mean for investors and the broader market?

Burry’s exit adds to a wave of veteran short sellers retreating amid an AI-driven market boom, raising questions about sustainability and transparency in tech valuations.

Q8. Could Burry’s move signal another financial warning?

Given his history of contrarian predictions, many investors see his withdrawal as a cautionary signal, especially regarding overvalued tech and AI sectors.