Governance in a Hard-Edged World: ESG, the JSE, and Africa’s Capital Advantage

By Anushka Bogdanov

War-time supply chains, energy shocks, and information risk have made ESG less about slogans and more about operating reality. Leadership are being judged on how they secure energy, treat people, govern technology, and report decision-useful data. For South Africa and the continent, is a once-in-a-generation opportunity to deepen markets through better governance and measurement and not noise. This piece sets out what ESG really is, why Risk Insights (RI) built Africa’s data infrastructure, how exchange partnerships accelerate market depth, and why stakeholder value not narrow agency theory must anchor leadership across a more multipolar world.

What ESG is (and isn’t)

ESG (environmental, social, governance) is the operating system for long-term value. It connects climate and nature risks, human capital and inclusion, supply chains, ethics, and board oversight to both financial results and societal outcomes. The point is decision usefulness: metrics, targets and governance evidence that help investors price risk and help leadership steer strategy. Treat ESG as PR (public relations), and you invite mispricing and mistrust; treat it as a data-driven control system, and you lower your cost of capital and raise your odds of durable growth.

Reasons for Risk Insights embarking on this journey

Africa needs local-context, globally comparable ESG data so capital can flow efficiently and fairly. RI built ESG GPS™ to translate international standards into on-the-ground realities i.e., energy reliability, water stress, just transition, governance capacity, so issuers can disclose efficiently and investors can allocate confidently. Today, RI’s coverage spans nine African exchanges, i.e. JSE, SEM, GSE, NGX, NSX, BSE, USE, RSE, DSE providing asset owners a coherent pan-Africa view. RI extended into the Gulf and North Africa through partnership with the Federation of Arab Capital Markets. RI is currently the largest ESG data provider for Africa.

What the data covers (and why it’s competitive for the continent)

ESG GPS™ synthesizes layered signals:

- Governance foundations: board independence & skills, audit/risk, ethics & anti-corruption, pay alignment, shareholder rights, ownership transparency.

- Planet: emissions coverage & intensity, transition plans, energy mix, water, waste, biodiversity adjacency, targets & scenarios.

- People: safety, DEI, pay-equity signals, training, supply-chain labour rights, data privacy.

- Proof (disclosure quality): completeness, timeliness, assurance, alignment, controversies handling.

- Financial performance & market signals: long-run market-cap context and sentiment feeds to understand what the company is signalling and how the market responds.

This helps Africa compete with standardized comparability across uneven baselines; local relevance (CBAM exposure, carbon-tax linkages, water constraints); and automation/NLP to lower reporting costs and accelerate buy-side workflows.

Why did RI partner with JSE? Market plumbing scales change

Exchanges sit at the nexus of issuer guidance, investor expectations, and the pipes of the market. Working through them scales adoption and quality and it also and channels learning back to issuers. The JSE Sustainability & Climate Disclosure Guidance (June 2022) provided local issuers a roadmap aligned with global frameworks; South Africa’s Green Finance Taxonomy (2022) connected disclosure to capital flows.

The JSE’s structure, growth path and what it means for market depth

The JSE demutualised and self-listed in 2005–06, acquired the SAFEX (2001) and the Bond Exchange (2009), it operates across multiple markets, and clears listed derivatives via JSE Clear while equities settle via Strate. This “for-profit exchange and self-regulatory obligations” (SRO) model isn’t unique globally, but it does require strong conflict-management.

Some of the JSE’s competitiveness pressures:

- Settlement speed & liquidity shape depth. Cash equities remain T+3 in South Africa while others move to T+2/T+1; liquidity at the JSE is highly concentrated with Top-40 counters = ~83% of ADV (average daily value), while small and micro caps (70% by count) trade ~2%. Competition from A2X/CTSE lowers costs but fragments order flow making consolidated data and best execution crucial.

- Trajectory & policy overhang. After years of delistings, 2024 saw green shoots (eight new listings) with momentum into 2025, proof that the pipeline can revive as macro and plumbing improve. EU recognition issues linked to FATF (Financial Action Task Force) grey-listing added friction; progress on remediation aims to lift that overhang.

What would deepen SA’s markets now: shorten settlement cycles; expand CCP (Central Counterparty) coverage; keep SME listing and ownership costs competitive; and scale green and sustainability-linked debt segments anchored to the SA taxonomy.

Is the SRO model “good”? A balanced view

There are upsides which include domain expertise and speed; a lower burden on taxpayers; industry buy-in; faster pilots of market-structure change. However there are downsides as well which include conflicts of interest; risk of capture under-enforcement; due-process vulnerabilities and fragmentation. The guardrails that make it work are clear statutory oversight, ring-fenced regulatory arms inside exchange groups, and transparent enforcement metrics. So from a net-net perspective it is good in principle but conditional in practice.

Did the JSE–RI Relationship make sense?

ESG GPS™ launched years before the JSE engagement as ESG mainstreamed and South Africa introduced guidance and taxonomy. Exchanges needed scalable, Africa-relevant data; issuers needed lower reporting friction; investors demanded comparability. The partnership made sense for South Africa for both parties and for international investors.

The JSE, public scrutiny and stakeholder value

Media cycles and reputational noise are a governance stress-test for any market. The remedy is more governance, not less: transparent controls, independent assurance, clear role separation, and continuity plans that protect customers, investors, and staff. Doubt raises risk premia and destroys value across the system, especially in emerging markets competing for global capital. Africa cannot afford value destruction through innuendo when what truly matters is data, delivery, and outcomes.

The reality check is that markets often treat crises unevenly “different strokes for different folks.” For e.g., Boeing orders, Meta user scale, Volkswagen sales each shows how demand can persist despite headlines. The lesson is that reputational events don’t uniformly kill demand; credible governance, transparent data and consistent performance build resilience.

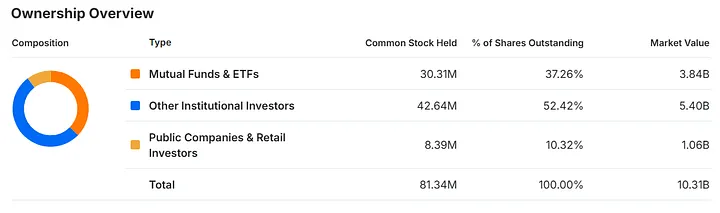

The shareholders of the JSE Limited as of the latest available figures include:

Source: https://www.investing.com/equities/jse-ownership

Geopolitics, the Global South, and what leadership need to focus on

Ukraine and Gaza made ESG more hard-edged as energy security, war-time human-rights exposure, sanctions, misinformation risks, and defence adjacency now show up in financials and brand equity. Supply-chain rerouting via the Cape raised costs, transit times, and CO₂ now a live Scope 3 and working-capital issue. In parallel, a more multipolar landscape (BRICS expansion, Russia and Asia flows, Turkey’s mediation) demands scenario-ready governance.

Board and Leadership to-dos:

- Run geo-ESG scenarios alongside climate taking into account energy cut-offs, Red Sea/Suez disruptions, sanctions snapbacks, disinformation attacks.

- Dual-track energy strategy considering near-term resilience and credible decarbonisation.

- Human-rights due diligence at scale (CSDDD/UNGP) by mapping suppliers, conflict adjacency, remedy pathways.

- Clear policy on defence exposure (if any), with red lines and product-use SME reviews.

- Treat platform and content risk as governance risk if you advertise on or are a platform.

Equality, technology, accountability ESG for South Africa

- Equality & inclusion drive productivity, not PR and measure what matters (pay-equity signals, safety, training, DEI).

- Technology lowers issuer reporting costs and surfaces material risks (water stress, just-transition exposure).

- Accountability via a common measurement language (ISSB baseline and SA taxonomy) turns governance into growth.

Bringing it back to RI and to stakeholders

Our mission when I started the ESG journey was has never been about titles; it’s about always about outcomes: better data leads to better disclosure which leads to better capital allocation and better resilience for Africans. We chose not to gear the company, not to take grants, and not to sell the company during the past five years because controlling the Africa narrative matters so impact isn’t derailed by outsiders who don’t understand the continent’s diversity or its centrality to the green transition.

Call to action: If we want deeper markets, cheaper capital, and fairer growth, we need stakeholder value as the governing idea and evidence rich ESG data as the discipline. That is the work. Let’s get on with it.

Disclosure: Views are my own. Data points are as of publication. By Anushka Bogdanov