Battle of Survival: Tips for Surviving as a Recent Graduate or Corps Member

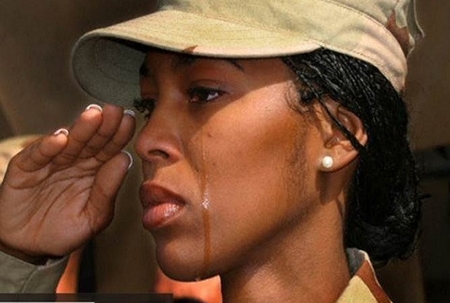

NYSC corps member: Photo Credit: Tori News

The battle for survival among Nigerian Youths today has increased significantly. This even became worse immediately after the fuel subsidy removal.

It is true that the current inflation and economic hardship, especially as food prices, cosmetics, and clothing continue to soar in a country where remuneration and salaries are not rising at the same rate, are affecting almost all citizens. Evidently, young people, especially recent graduates or those currently serving their fatherland in the National Youth Service Corps (NYSC), face even much greater struggles.

A recent report highlighted that Nigeria’s food inflation rate stood at 23.51% in February 2025, compared to 26.08% in January. While the government celebrates this marginal decline, the reality is that food prices remain high, making it increasingly difficult for young Nigerians to afford necessities.

For undergraduate students, parental support often provides a financial cushion. However, with many parents battling economic hardships, this support is no longer guaranteed. Imagine being a recent graduate, no longer receiving parental support, yet struggling to survive on an entry-level salary of 30,000 and 50,000, if you are lucky enough to have a job.

Read Also

Surviving on ₦33,000: Amnesty International, NYSC and the fight for

Should NYSC be removed? Debate over relevance in modern Nigeria

Silicon Valley Nigeria partners with NYSC to boost youth empowerment

The reality is grim: NYSC members earning ₦33,000 barely make enough for transportation, let alone savings. Since those who have secured jobs are complaining; how much worse is it for fresh graduates still searching?

The recent outcry from an NYSC member, Ushie Uguamaye, also known as Raye, who apologised after publicly expressing frustration about Nigeria’s economic situation, is evidence that young people are facing severe financial distress. According to her, “I want better for myself. (And I hope you do too). The complaints I made are valid regardless of whatever ‘lifestyle’ you think I am living.

She also said that she works 45+ hours a week and should be able to afford hanging out with her friends every weekend. “However, I can’t. But how many of us can afford to hang out with our friends? How many can afford that in reality? You spend all week working and can’t even feel alive during the weekends.”

Practical Strategies for Surviving as a Recent Graduate or Corps Member

In the midst of these, here are few tips on how one can survive as a recent graduate:

- Develop a Budget: Create a detailed budget that tracks all income sources and expenses. This practice helps identify areas where spending can be reduced and ensures that essential needs are prioritized.

- Build an Emergency Fund: Aim to save at least 10-20% of your income to establish a financial cushion for unexpected expenses.

- Reduce Unnecessary Expenses: Identify and eliminate non-essential spending. This might involve cooking at home instead of dining out, utilizing public transportation, or sharing accommodation to split costs.

- Leverage Student Discounts and Deals: Many businesses offer discounts to students and recent graduates. Always inquire about available deals to reduce costs on essentials and services.

- Pursue Additional Income Streams: Consider part-time jobs, freelancing, or monetizing a hobby to supplement your income. Diversifying income sources can alleviate financial pressure and accelerate savings

- Invest in Financial Literacy: Educate yourself on personal finance topics such as saving, investing, and debt management. A strong understanding of these areas can lead to better financial decisions.

- Utilize Financial Management Tools: Employ budgeting apps and financial planning tools to monitor spending and manage finances effectively. These tools can provide insights into spending habits and help maintain financial discipline.

By implementing these strategies, young Nigerians can better navigate the current economic landscape, build financial resilience, and work towards a secure financial future.

As we continue to call on the government to hear our cry and implement policies that support youth employment, fair wages, and economic stability, young people must take proactive steps toward financial survival in these challenging times.