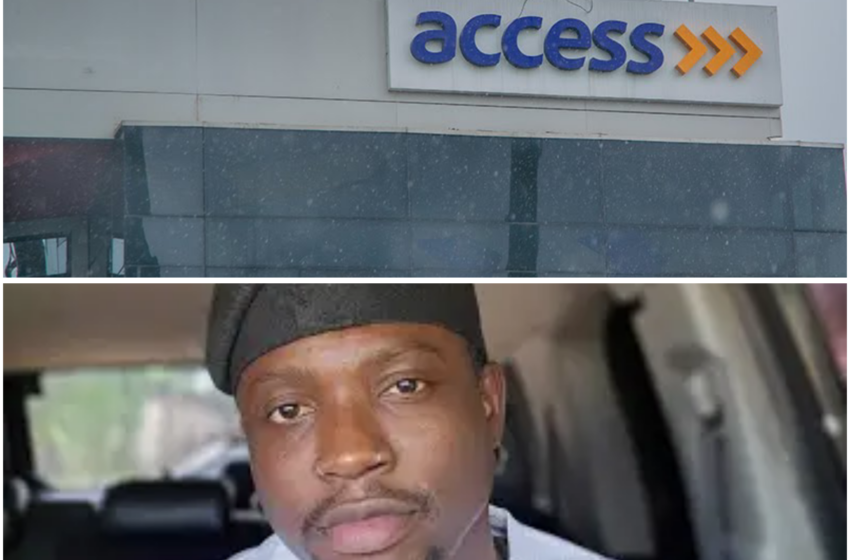

Access Bank: Did N500m go missing from deceased customer’s account as claimed?

Access Bank has denied allegations of fraudulent practices involving the account of a deceased customer, Idongesit Edeth Awah, who reportedly left no will.

Social media influencer Vincent Otse, popularly known as VeryDarkMan, sparked controversy after alleging in a viral video that N500 million was missing from Awah’s account with the bank.

According to Otse, Awah informed his sister about his funds in various banks before his passing. While other banks provided statements consistent with his disclosures, Access Bank allegedly did not comply.

Responding on Sunday, Access Bank released a statement firmly dismissing the allegations. It stated,

“Our attention has been drawn to a video on social media wherein allegations of missing funds and unethical behaviour have been made against Access Bank Plc. First and foremost, we wish to emphasise that the safety and security of our customers’ funds are core priorities that we take seriously.

“The allegations of missing funds in the bank are most untrue and baseless. There is no N500m or any other fund or amount missing from the subject customer’s account or any other customer’s account with us.”

READ ALSO

TD Jakes’ health fails during sermon amid Diddy-related probe… all to know

Grass to Grace Series (32): Mark Angel — from N10k salary to multi-millionaire

Man blames Access Bank app for daughter’s death… how to avoid such experience

Access Bank emphasised that independent investigations had corroborated its stance, and the institution operates with the “highest ethical standards.” Urging Nigerians to disregard unverified claims, stating, “We protect our customers’ interests whilst also respecting privacy laws.”

How to Claim Deceased Relatives’ Funds Without a Will

For families in situations similar to that of the Awah family, claiming funds from a deceased relative’s account without a will requires specific legal steps:

1. Obtain a Letter of Administration: The next of kin must apply for this document at a probate court. It grants legal authority to manage the deceased’s estate.

2. Provide Identification and Death Certificate: The bank will require the claimant’s valid ID and the deceased’s death certificate.

3. Submit a Bank Statement Request: Next of kin should officially request the account details from the bank.

4. Notify the Bank: Inform the bank of the death and submit all required documents.

However it is advised to document your finances and consider writing wills to simplify the management of your estates after death.